Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A low ratio may indicate that the company will have trouble paying its bills. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Is there any other context you can provide?

The key distinction here is the term “most liquid assets”—these are assets that can be converted into cash quickly (hence the word “quick” in the ratio’s name). Unlike the Current Ratio, which includes inventory in the calculation, the Quick Ratio excludes this less liquid asset. By focusing on more liquid assets, the Quick Ratio emphasizes a company’s ability to pay off its debts quickly, which can be especially critical during economic downturns or unexpected financial hardships. A company can’t exist without cash flow and the ability to pay its bills as they come due. By measuring its quick ratio, a company can better understand what resources it has in the very short term in case it needs to liquidate current assets. The quick ratio communicates how well a company will be able to pay its short-term debts using only the most liquid of assets.

Formula for the Quick Ratio

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed how do i enter form 8862 resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The calculators provided on this website are for educational purposes only. Users shall be solely responsible when using the information/calculators provided on this website.

Submit to get your question answered.

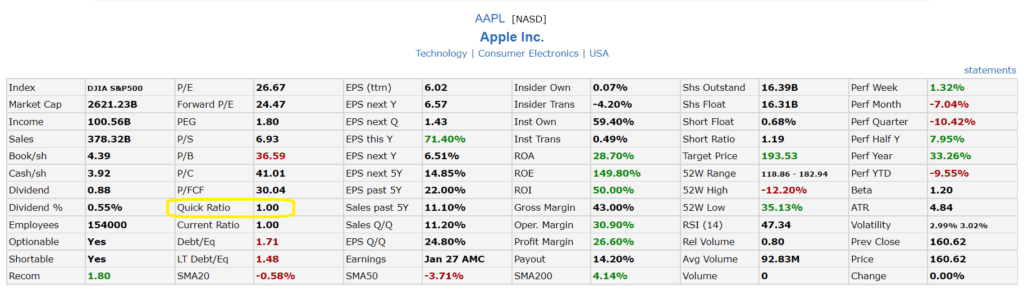

Generally, the higher the ratio, the better the liquidity position. A quick ratio of 1.0 means that for every $1 a company has in current liabilities, it also has $1 in quick assets. Whether you’re an investor, a creditor, or a company executive, understanding the quick ratio can provide critical insights into a company’s short-term financial health. This is because the formula’s numerator (the most liquid current assets) will be higher than the formula’s denominator (the company’s current liabilities). A higher quick ratio signals that a company can be more liquid and generate cash quickly in case of emergency. The quick ratio is more conservative than the current ratio because it excludes inventory and other current assets, which are generally more difficult to turn into cash.

How is the quick ratio calculated?

When analyzing Financial Statements, it is very important to use the correct Financial Ratios. You should always use the most recent income statement and balance sheet. However, you will want to use the quick ratio when analyzing a firm’s liquidity position in order to gain an idea of how quickly they could pay off their short-term debts. If they can’t, then there may be some problems in terms of liquidity. The quick ratio is equivalent to the acid test ratio in GAAP accounting, which approaches the same number by netting certain assets from current assets.

- This means that Carole can pay off all of her current liabilities with quick assets and still have some quick assets left over.

- The current ratio, on the other hand, considers inventory and prepaid expense assets.

- A company that needs advance payments or allows only 30 days for customers to pay will be in a better liquidity position than a company that gives 90 days.

- The calculators provided on this website are for educational purposes only.

- While the quick ratio is not a perfect indicator of liquidity, it is one tool that analysts use to get a snapshot of how well a company can meet its short-term obligations.

- Indeed, while both the quick ratio and the current ratio aim to measure a company’s ability to cover its short-term liabilities, they offer different perspectives due to their varied treatment of inventory.

Our Services

The quick ratio (QR)is also known as acid test ratio and measures the liquidity of a company translated as its ability of paying in due time its short term debts. It’s easy to calculate the quick ratio formula and run financial reports with QuickBooks accounting software. Its cloud-based system tracks all your financial information and gives you fast access to your current assets and liabilities. You can spend less time running the numbers and more time driving success.

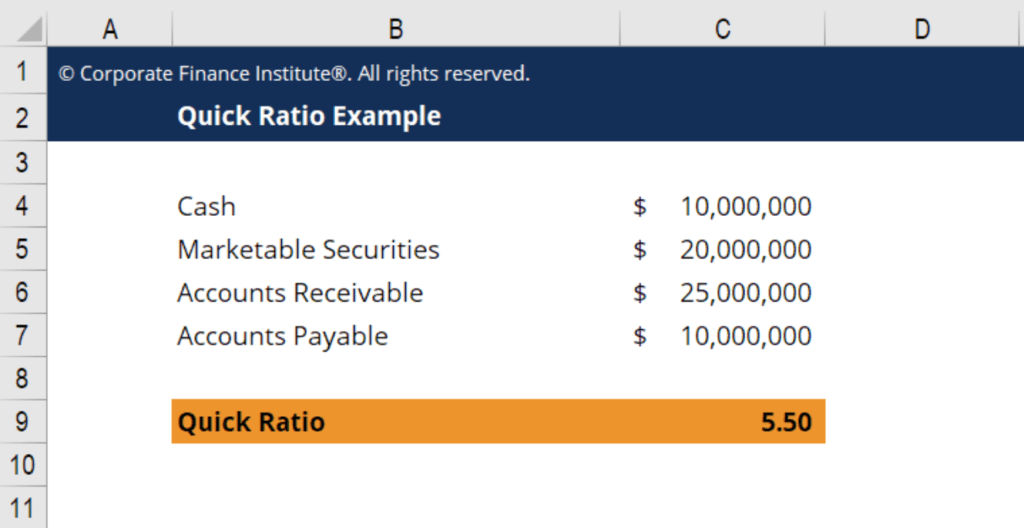

Pre-paid assets are also not considered to be a liquid asset. A company can convert quick assets to cash in less than 90 days, while some current assets can take up to a year. The quick ratio is a more conservative measure of liquidity than the current ratio. The quick ratio formula is a company’s quick assets divided by its current liabilities. It’s a financial ratio measuring your ability to pay current liabilities with assets that quickly convert to cash. The quick ratio is an indicator that measures a company’s ability to meet its short-term financial obligations.

This discrepancy can lead to interesting insights in financial analysis. A company could show a strong current ratio, suggesting sound liquidity. However, a closer examination via the quick ratio could tell a different story, revealing potential weaknesses in liquidity once the less liquid inventory is excluded. Therefore, understanding both ratios and their unique perspectives can provide a more holistic and accurate picture of a company’s short-term financial health. The quick ratio, often referred to as the “acid test ratio,” is a liquidity metric used to gauge a company’s capacity to pay its short-term obligations using its most liquid assets.

A quick ratio of 1 or higher is generally considered good, as it indicates that a company can meet its short-term liabilities with its most liquid assets. When analyzing a company’s liquidity, it is a good practice to compare its current value to values calculated from previous financial statements. It is also worth obtaining the average liquidity ratios in companies similar to those analyzed. It can provide information about company trends and act as an early warning sign of a problem. A quick ratio equal to 1.0 means that the value of a company’s assets that are precisely convertible to cash exactly match its current liabilities. The quick ratio lower than 1 indicates that a company, at a particular moment, cannot fully pay back its current obligations.

Quick assets for this purpose include cash, marketable securities, and good debtors only. In other words, prepaid expenses and inventories are not included in quick assets because there may be doubts about the quick liquidity of inventory. The Quick Ratio is a valuable financial tool for evaluating a company’s liquidity and ability to meet short-term obligations. By calculating the Quick Ratio regularly, you can gain insights into your company’s financial health and make informed decisions to improve its liquidity position. Use our Quick Ratio Calculator to quickly and accurately assess your company’s financial standing and plan for a secure financial future. The Quick Ratio is a measure of liquidity, while working capital represents the difference between current assets and current liabilities.

In terms of accounts receivables, the quick ratio does not take into account the turnover rate or the average collection period. The quick ratio is ideal for short-term creditors who want to know how quickly they will be paid back if the company were to go bankrupt. This means it may suffer from illiquidity which could lead to financial distress or bankruptcy. In addition, considering companies in similar industries and sectors might provide an even clearer picture of the firm’s current liquidity situation.