This isn’t feasible for most people managing multiple rental properties and accounts. Unless you’re a Quickbooks pro, you may be better off using purpose-built accounting software for property management. Bookkeeping is crucial for Airbnb hosts as it helps keep track of their finances and ensure that they are maximizing their earnings. It also helps with tax preparation and compliance, making it easier to report income and expenses accurately.

- There is a learning curve for the setup that requires you to enter income and expenses manually.

- This detailed documentation will enable you to assess your business’s profitability and make strategic financial decisions.

- Making money is great, but paying taxes on your hard-earned income is significantly less exciting.

- For instance, you can choose which income platforms and expense categories you wish to track.

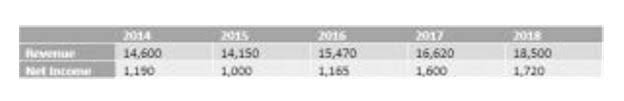

- Compare your revenue by month or year, using the Annual Statement report.

- Intuit QuickBooks, a stalwart in the accounting software market, emerges as the top comprehensive bookkeeping solution for Airbnb hosts and those who co host Airbnb properties.

- What should hosts look for while choosing the best accounting software for Airbnb?

Airbnb Spreadsheet Summary

In this article I will explain to you the key steps involved in creating a short term vacation spreadsheet. I will even provide you with a simple download to my free Airbnb spreadsheet template. 1% cash back is credited instantly following purchase with no maximum spend. ATM transactions, the purchase of money orders or cash equivalents, and account funding made with your debit card are not eligible for cash back. With so much uncertainty about what will happen with the economy, it can be difficult to identify where to go as a rental property investor. Many financial experts recommend setting aside 30-35% of your Airbnb income to cover your quarterly tax payments and annual tax liability.

- The Ultimate Airbnb Hosts Accounting & Bookkeeping Guide offers comprehensive insights.

- The Bnbtally integration allows you to generate detailed invoices and bills for each reservation and automates payments to invoices to streamline reconciliation.

- To report Airbnb rental income and expenses, you’ll need to file a Schedule C or Schedule E (Form 1040) with the IRS.

- As a result, running a short-term rental can be very time-consuming if you do everything yourself.

- Effective bookkeeping and accounting are not just about numbers but about empowering your Airbnb business to flourish.

- Examples of Airbnb deductible tax expenses include property maintenance, travel expenses, advertising costs and even mortgage interest.

- With FreshBooks, managing your Airbnb accounting becomes a breeze, not a chore.

Airbnb Accounting: Best Practices for Hosts

Tracking every what are retained earnings financial transaction is where hosts usually fall off the rails. Your Airbnb tax report will only include gross earnings, withholdings, and adjustments for using the rental site. If you don’t want to foot the tax bill on your gross rental income, you’re responsible for keeping tabs on the rest. These transactions should be organized into a consolidated record of accounts called a general ledger.

Consider Hiring a Skilled and Reliable Accountant

Our team is ready to learn about your business and guide you to the right solution. The user-friendly interface of QuickBooks Online is what really sets it apart. It’s easy to navigate, and the features are intuitively designed, making the learning curve less steep for new users. However, some users have expressed concerns regarding the limitation on the number of team members and the speed of customer service.

- I like to keep these on an individual tab, keeping them separate from ongoing costs.

- It allows you to analyze trends, identify areas for improvement, and make informed decisions about pricing, marketing strategies, and home improvements.

- Below, we talk about Airbnb to get a deep understanding of Airbnb income tax rules to comply with regulations and increase deductions.

- You should open a separate bank account for your Airbnb business and use it exclusively for business transactions.

- Airbnb accounting software helps you avoid these pitfalls by automating income and expense tracking and ensuring your financial data is accurate and up-to-date at all times.

Open a Bank Account Specifically for the Business

For instance, you can choose which income platforms and expense categories you wish to track. Once you have all your revenues and expenses tracked, you’re able to manipulate the Bookkeeping for Veterinarians data to show you want. You’ll even be able to create beautiful graphs and charts to display data as well. These are all the costs of setting up your Airbnb, prior to the listing going live.

Baselane’s virtual accounts keep everything organized, so you won’t waste time sorting through transactions to figure out which expenses belong to which property. By staying on top of your numbers, you’ll also be well prepared for tax season and avoid surprises from our dear friend the IRS. The income you get from renting out your property on Airbnb is taxable, so it’s important to understand your tax obligations as an Airbnb host. You may be required to pay federal and state income tax and taxes that apply to short-term rentals on the local level.

Xero: Most user-friendly software

- First and foremost, it allows you to track your rental income and expenses accurately.

- Tracking your financial performance is essential for understanding the profitability of your Airbnb business.

- While all the solutions reviewed in this post are top-notch, they each have their strengths and cater to different needs.

- Airbnb may send Form 1099-K, depending on how many reservations or payments you receive in a calendar.

But these are minor drawbacks compared to the comprehensive functionality that QuickBooks Online offers. With QuickBooks Online, you can efficiently manage your finances and stay on top of your Airbnb business. Landlords can accept payments from tenants bookkeeping for airbnb using Wave Payments, a paid service that lets me accept guest payments online.

Maintain a separate bank account for your rental properties

Employing the right bookkeeping system will not only ensure compliance with tax regulations but also optimize your profits by maximizing eligible deductions. By recognizing the distinct characteristics of Airbnb bookkeeping, you can efficiently manage your finances, make informed decisions, and foster the growth of your home-based hospitality business. It’s easy to lose sight of where your money is going when you’re juggling multiple tools and spreadsheets to manage your short-term rental property. Baselane puts all your finances in one place and provides real-time insights into your cash flow for a clear picture of how each property is performing. Easily analyze income and expenses to decide when to adjust rental rates, cut spending, or expand your portfolio. To effectively manage your Airbnb finances, it’s crucial to diligently record your rental income and expenses.

The Baselane Visa Debit Card is issued by Thread Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC. If you don’t provide the correct W-9 taxpayer information, Airbnb will withhold income taxes from your payouts. Airbnb collects and remits local taxes on behalf of hosts in certain states and cities.